Build a Personal Trading Journal Want to improve your trading skills? A personal trading journal can really help. It’s not just for writing down wins and losses — it helps you learn from every trade, see what works, and understand your own habits.

Even if you’re new to trading, keeping a journal can make a big difference. It helps you stay focused, avoid emotional mistakes, and trade with more confidence. In this simple guide, we’ll show you what to write in your journal, why it’s useful, and how it can help you become a smarter and more successful trader.

How to Make Your Own Trading Journal (With Easy Examples from STRATEGIC)

A trading journal is not just a notebook. It’s your personal guide to becoming a better trader. At STRATEGIC, we believe every trader should keep a journal. It’s not just helpful — it’s very important.

In this blog, we’ll show you why a trading journal matters, how to make one, and how our team at STRATEGIC uses it to help new and experienced traders grow.

Why a Trading Journal Is Important for Every Trader

If you’re serious about improving your trading, keeping a trading journal is one of the smartest things you can do. Many traders lose money — not because their strategy is bad, but because they don’t fully understand their own actions, emotions, and habits.

A trading journal helps you see what’s really going on. By writing down each trade, you can spot patterns — like which setups work best for you, or what times of day you trade better. These insights can help you repeat your good habits and fix the bad ones.

It also shows you emotional mistakes. Maybe you trade when you’re stressed or try to win back money after a loss. A journal makes you aware of these behaviors, so you can avoid them next time.

Another big benefit is that it helps you understand how you feel while trading. Were you calm or nervous? Did you rush in or wait for confirmation? Noticing your emotions helps you stay in control and make better decisions.

Over time, your journal becomes a helpful guide. You can look back, learn from your past trades, and keep improving. Instead of guessing, you’ll be making decisions based on real experiences.

It changes guessing into learning and improving.

What to Write in Your Trading Journal – Simple and Easy

Keeping a trading journal helps you understand your trades better and improve faster. But what should you write in it? Don’t worry — here’s a simple guide to help you.

1. When and Why You Took the Trade

Write the date and time you entered and exited the trade. Also explain why you took it. For example, maybe the price broke a support level or touched a trendline. This helps you remember what made you decide.

2. Picture of the Chart

Take a screenshot of your chart when you entered the trade. Mark the entry and exit points. This is useful later when you want to review what you saw at that moment.

3. Risk and Reward

Write how much you risked (your stop-loss) and how much you aimed to make (your target). For example, risking $10 to make $20 is a 1:2 ratio. This helps you see if your trades are smart and worth the risk.

4. Your Feelings During the Trade

Trading isn’t just about numbers — it’s also about emotions. Write how you felt before, during, and after the trade. Were you calm, scared, or overconfident? This helps you spot patterns in your behavior.

5. What Happened and What You Learned

Did you win or lose the trade? More importantly, what did you learn? Even a losing trade can teach you something valuable, like being more patient or following your plan better.

6. Was This Trade in Your Plan?

Ask yourself: “Did I take this trade because it matched my strategy, or was it just random?” This helps you stay disciplined and avoid emotional trades.

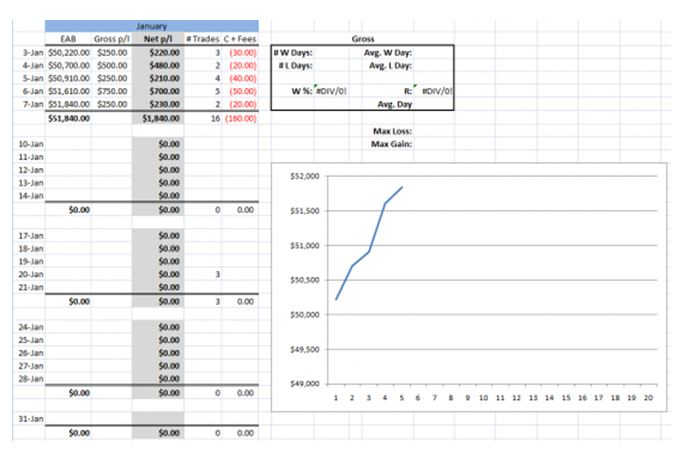

Simple Trading Journal Example (STRATEGIC Style)

If you’re not sure how to start a trading journal, don’t worry. Here’s a very easy example to help you. Writing things down like this can help you stay on track, learn from your trades, and become a better trader over time.

Date: July 21, 2025

Write the date of your trade. It helps you stay organized and track your progress each day.

Trade Pair: XAU/USD (Gold)

This is the currency pair or asset you traded. Writing this helps you see which pairs work well for your strategy.

Why I Took the Trade

“The price broke a strong level on the 4-hour chart and came back to test it again. I saw a clear signal and decided to enter the trade.”

Write down why you entered the trade. Was it a chart pattern? A signal from your system? This helps you understand if you followed your plan or made a random choice.

Risk and Reward

“I risked 1% of my account.

My stop loss was 50 pips.

My take profit was 100 pips.

That means I was aiming to make double the amount I was risking (1:2 ratio).”

This shows your risk management. You’re saying how much you were willing to lose and how much you hoped to gain. A 1:2 ratio means your wins can be bigger than your losses — a smart way to trade.

Why This Is a Good Example

This journal entry is short and clear. It shows that:

-

The trade had a good reason

-

You managed risk properly

-

You followed a calm, logical plan

Writing your trades like this helps you learn faster. You’ll start to see what works, avoid repeating mistakes, and build more confidence in your trading.

How I Felt:

I was focused but a little nervous because I had lost two trades earlier that day.

Result:

The trade was successful and reached my Take Profit.

Lesson Learned:

I followed my plan perfectly and didn’t let my emotions take over. I stayed calm and focused, which helped me win.

Why This Journal Entry Is Helpful

Writing your trades like this helps you see what’s working and what’s not. It shows your mindset, your risk, your plan, and what you can improve. Over time, these notes will help you become more confident and consistent in your trading.

Would you like me to create a fill-in-the-blank journal template you can use every day?

Why Adding Screenshots to Your Trading Journal Is So Important

Writing down your trades is a great habit — but adding screenshots of your charts takes your trading journal to the next level. At STRATEGIC, we always recommend saving screenshots for every trade. Here’s why:

Visual Memory Is Stronger Than Words

Our brains remember pictures better than just numbers or notes. A screenshot captures the exact chart setup at the time you entered and exited your trade.

Even weeks or months later, you can quickly recall what the market looked like and why you made certain decisions. This helps you learn faster.

You See the Real Market Conditions

Screenshots show things that numbers alone can’t:

-

Where the price was when you entered

-

How clean or messy the setup looked

-

What indicators or signals were present

-

Where support and resistance levels were

This helps you understand how good your entry really was — not just whether you won or lost.

You Can Spot Patterns More Clearly

When you collect screenshots over time, you’ll start to notice patterns:

-

What your best setups look like visually

-

What your losing trades often have in common

-

Which market conditions suit your strategy

This kind of visual review is powerful for improving your decision-making.

Learn From Mistakes and Wins

Looking at your screenshots makes it easy to:

-

See what went wrong in losing trades

-

Understand what worked well in winning trades

-

Review your emotional state (did you rush in? were you patient?)

-

Compare your trade to your plan

This helps you make smarter choices in the future.

Better Review Better Growth

Let’s say you’re reviewing your week or month. Instead of reading through long notes, you can quickly flip through your screenshots and instantly remember each trade.

You’ll see which setups are worth repeating — and which ones you should avoid.

Tips for Using Screenshots in Your Journal

-

Take a screenshot before and after the trade if possible

-

Mark your entry, stop loss, and take profit on the chart

-

Add short notes directly on the image (like “breakout retest” or “bad timing”)

-

Store them in folders by week or by trade type (optional)

How STRATEGIC Checks Student Trading Journals (And Why It’s So Helpful)

At STRATEGIC, we believe that a trading journal is more than just writing down profits or losses. It’s about learning, growing, and understanding yourself as a trader. That’s why we’ve created a system to help students get better — faster and smarter.

Weekly Journal Check – Every Friday

Each Friday, our students send their trading journals to their mentors. This weekly habit keeps them focused and helps them stay on track. But mentors don’t just look at whether the trade made money — they look deeper to help the student learn and improve.

What Mentors Look At

1. Emotions and Mindset

Mentors read about how students felt during the trade. Were they calm or stressed? Did they follow logic or trade from fear or revenge? These emotions matter a lot in trading. Understanding them helps students avoid emotional mistakes next time.

2. Following the Plan

Every trader should have a plan — and stick to it. Mentors check if each trade matched the plan. Even if a trade made profit, if it wasn’t part of the strategy, it’s not considered a success. The goal is smart, consistent trading, not random lucky wins.

3. Risk Management

Risk control is very important. Mentors check if the student used proper lot sizes, stop losses, and take profits. They also make sure the student didn’t risk too much or overtrade. Good risk management helps protect your account and keeps you trading longer.

Personalized Feedback That Helps You Grow

After reviewing everything, mentors give kind and helpful feedback. They explain:

-

What the student did well

-

What could be better

-

Tips to improve setups, stay disciplined, and control emotions

-

Motivation to keep improving

This feedback helps students grow in both strategy and mindset — not just focus on profits.

Why It Matters

This weekly review system helps students:

-

Build better habits

-

Stay consistent

-

Learn from mistakes

-

Become calm, focused, and confident traders

At STRATEGIC, we don’t just teach trading skills — we help build smart, responsible traders step by step.

Easy Things to Track in Your Trading Journal

To become a better trader, it’s helpful to look at your trades every week. By checking a few simple things, you can learn what’s working and what’s not.

Did you follow your plan?

Check if you followed your trading rules. If you didn’t, ask yourself why. The more you stick to your plan, the more consistent your results will be.

How many trades did you win or lose?

Count how many trades went well and how many didn’t. This shows if you’re improving over time.

What was your risk vs. reward?

Think about how much you risked compared to how much you could gain. A smart trader always tries to make more than they risk.

Did your emotions affect your trades?

Were you scared, excited, or stressed when trading? If emotions changed your decisions, write that down. It helps you stay more in control next time.

How confident did you feel?

Ask yourself: Did I feel sure about this trade? Or was I just guessing? Writing this helps you know when you’re truly ready to take a trade.

By tracking these simple points, you’ll start to understand your trading habits better and make smarter choices every week.

Why Writing in a Trading Journal Every Day is Helpful

Writing in your trading journal every day may seem simple, but it can really help you become a better trader. Here’s why:

Clears Your Mind

After trading, your mind can feel busy or stressed. Writing down what happened helps you feel calm. It’s like cleaning up your thoughts so you’re ready for the next day with a clear head.

Builds Discipline and Routine

When you write in your journal daily, you start building a good habit. It teaches you to be consistent and stay focused. Even on days when you don’t feel like it, this habit helps you stay on track — just like professional traders.

Helps You See Patterns

Journaling shows you what you do often — both the good and bad. For example:

– Maybe you lose more when you trade late at night

– Or you win more when you follow your plan

These patterns help you learn from your mistakes and repeat your wins.

Keeps Your Emotions in Check

Trading can be emotional — you might feel fear, greed, or stress. A journal helps you understand how you felt during trades and how that affected your decisions. This makes you more aware and helps you trade with logic, not just feelings.

What Happens If You Don’t Use a Trading Journal

If you don’t write down your trades and how you feel during them, you might keep making the same mistakes without even knowing it. Let’s look at some common problems traders face when they don’t keep a journal:

1. Making the Same Emotional Mistakes Over and Over

Without a journal, you can forget what caused you to lose money. Maybe you rushed into trades because you were too excited, or held on too long because you were scared. If you don’t write it down, you might repeat the same mistake again and again.

2. Blaming the Market Instead of Learning

When things go wrong, it’s easy to say, “The market was bad.” But that doesn’t help you get better. A journal helps you see what you could have done differently, so you learn from your own choices — not just blame the market.

3. Thinking You’re Doing Better Than You Are

Your memory can trick you. You might remember all the good trades and forget the bad ones. That makes you feel like you’re doing well — even if you’re not. A journal shows the full truth, so you stay realistic and focused.

4. Forgetting How Your Feelings Affect Your Trades

How you feel matters in trading. Being tired, stressed, or too confident can lead to bad decisions. When you write about your emotions in a journal, you start to see patterns. This helps you stay calm and make smarter choices.

FAQs

1. What is a trading journal?

A trading journal is a place where you write down details about every trade you make. It helps you track your progress, learn from your mistakes, and improve over time.

2. Why do I need a trading journal?

A journal shows you your habits, strengths, and areas where you need to improve. It helps you become more consistent and avoid emotional mistakes.

3. What should I write in my trading journal?

Include details like:

-

The date and time

-

What you traded (e.g., EUR/USD)

-

Why you entered the trade

-

Your stop loss and take profit

-

How you felt during the trade

-

The result and what you learned

4. How often should I update my trading journal?

Update it after every trade or at least at the end of each trading day. This builds discipline and keeps your trading mindset sharp.

5. Should I include screenshots in my trading journal?

Yes! Screenshots of your chart at the time of entry and exit can help you remember the setup more clearly. Visual notes are very helpful when reviewing trades later.

6. Can I use a digital journal or do I need a notebook?

Both are fine. Some traders prefer writing by hand in a notebook, while others use tools like Excel, Notion, or Google Docs. Use what feels easy and comfortable for you.

7. How does journaling improve my trading results?

When you review your past trades, you start to see patterns — like what works best for you, and what to avoid. This helps you make smarter, more confident decisions.

8. What if I lose money even after journaling?

That’s okay. A trading journal helps you learn faster from losses. It’s not about avoiding losses completely — it’s about understanding why they happened and fixing the mistake.

9. Is journaling only for beginners?

Not at all. Even professional traders keep journals. It’s a key part of staying sharp, disciplined, and always improving.

10. Can journaling help with emotions like fear or greed?

Yes. Writing down your feelings before and after a trade helps you notice emotional patterns. Over time, this helps you stay calm and avoid impulsive decisions.

Final Thoughts: Start Journaling Today

At STRATEGIC, journaling is one of the first and most important things we teach. Even if you start for just one week, you’ll begin to see what you’re doing well and what needs fixing.

If you want to be a pro trader, act like one. That starts with a simple daily habit: writing in your trading journal.

Your journal shows the truth. Use it to grow and succeed.

want to read more articel visit our website

Big Shoutout to the guys who made this blog happen UDM.

1 Comment

furqan khawaja

July 27, 2025The stragety makes my mind independent and free of emotions i liked it