Mastering Fibonacci Retracement in the world of technical analysis, one tool has stood the test of time — not because it guarantees profit, but because it adds precision, discipline, and context to price movement: Fibonacci Retracement.

At STRATEGIC, we teach this tool not as a magical signal generator, but as part of a structured trading system.

Mastering Fibonacci Retracement: A Strategic Approach to Smart Trading

What Is Fibonacci Retracement? (Easy Explanation)

Fibonacci retracement is a tool that helps traders figure out where the price of a stock or currency might pause or reverse. It’s based on a simple idea: when the price moves up or down, it usually doesn’t go in a straight line — it often pulls back a little before continuing in the same direction.

How It Works

Let’s say the price of something goes from $100 to $150. After that big move, the price might drop a bit before going up again. Traders use the Fibonacci retracement tool to guess how far it might drop before it starts going up again.

The tool uses certain percentages to show these possible drop levels, like:

-

23.6%

-

38.2%

-

50%

-

61.8%

These numbers come from a special number pattern called the Fibonacci sequence, which is found in nature and math.

Why Traders Use It

-

To find good points to buy or sell

-

To spot possible support or resistance levels

-

To understand if the current trend will continue

Example Made Simple

If a price goes from $100 to $150, and then starts dropping — traders watch these levels:

-

Around $130 (38.2% level)

-

Around $125 (50% level)

-

Around $120 (61.8% level)

At any of these points, the price might stop dropping and start rising again. So, traders look at these levels as possible turning points.

Keep in Mind

-

It’s not 100% accurate — it’s just a guide.

-

Works better when used with other tools, like trend lines or patterns.

-

Best used when the market is trending, not moving sideways.

Why Does Fibonacci Retracement Work?

Fibonacci retracement works because:

-

Many traders use it, so these levels become important. When a lot of people are watching the same price levels, the price often reacts there.

-

It’s based on natural patterns found in math and nature — like the 61.8% ratio — which also show up in how people behave in the market.

-

Prices in the market usually move in waves — they go up, then come down a little, then go up again. Fibonacci levels help guess where the price might stop and turn

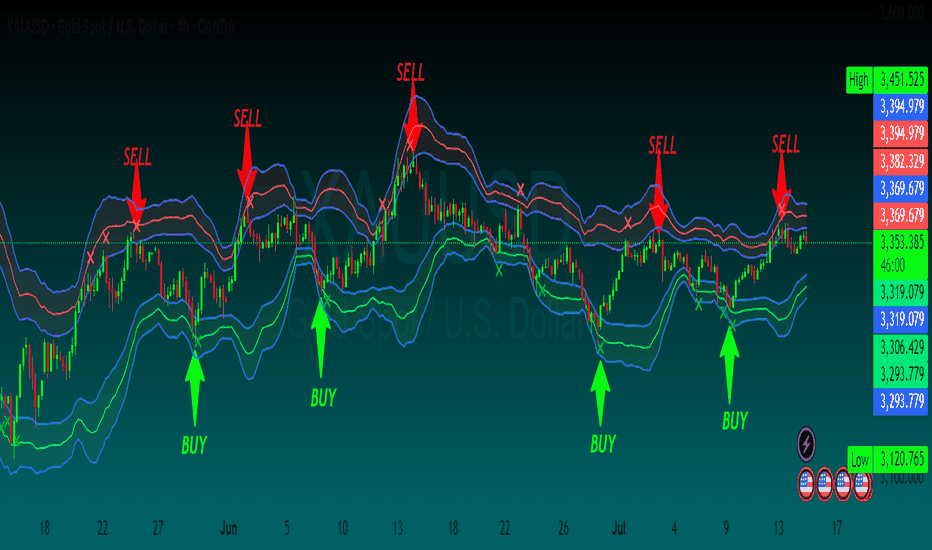

. 1. Finding Good Entry Points

When the market moves up or down a lot, we wait for it to pull back (go in the opposite direction for a bit).

We look at Fibonacci levels like 38.2% or 61.8% to see where the price might bounce back.

This helps us enter the trade at a better price.

2. Setting Profit Targets

After we enter a trade, we use Fibonacci extension levels to guess how far the price might go.

This helps us decide where to take profit — like at the 161.8% level.

3. Reducing Risk

We also use Fibonacci to place stop-loss orders.

That means if the price goes the wrong way, we get out of the trade quickly to avoid big losses.

4. Using It With Other Tools

We don’t use Fibonacci alone.

We also look at:

-

Trendlines

-

Support and resistance

-

Candlestick patterns

This helps us make better and safer trading choices.

In Simple Words:

At Strategic, Fibonacci helps us:

-

Buy at better prices

-

Know where to take profit

-

Keep our losses small

-

Trade with more confidence

It’s a smart tool that works well with our strategy.

How We Use Fibonacci at STRATEGIC (Easy & Simple)

Fibonacci retracement is a useful tool in trading, but using it alone isn’t enough. At STRATEGIC, we turn it into a full system by combining it with other smart trading techniques. This helps us enter trades with more confidence and less guesswork.

What We Use Alongside Fibonacci

We combine Fibonacci with:

-

Market Structure:

We look at how price is moving — is it making higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend)? -

Smart Money Concepts:

We look for liquidity grabs, where the market tricks traders before the real move begins. -

Candle Confirmation:

We wait for strong candles like engulfing patterns or rejection wicks before entering. -

Timing and Sessions:

We also watch for important times, like London or New York session opens, or major news events that affect the market.

Fibonacci is just a tool. But when used with a strategy, it becomes a full trading plan.

STRATEGIC’s 3-Step Fibonacci Strategy

Step 1: Find the Trend (Market Structure)

Before drawing Fibonacci, we first look at the direction of the market:

-

If the market is making higher highs and higher lows, it’s an uptrend.

-

If it’s making lower highs and lower lows, it’s a downtrend.

Never draw Fibonacci against the trend.

Example:

If price is going up and then dips slightly, we draw Fibonacci from the lowest point (start of the move) to the highest point (end of the move).

Step 2: Mark the Key Fibonacci Levels

The most important Fibonacci zones are:

-

38.2% – Small pullback (trend is still strong)

-

50% – Middle point (often respected)

-

61.8% – Golden level (good chance of a bounce or reversal)

We call the 61.8%–78.6% area the “Golden Pocket” — this is where smart money often enters the market.

If price enters this zone and starts rejecting, it’s a strong sign for a possible trade.

Step 3: Wait for a Confirmation Signal

We don’t enter the trade right away when price touches a Fibonacci level. We wait for proof.

Look for:

-

A strong bullish or bearish engulfing candle

-

A rejection wick (also called a pin bar)

-

A structure break on a smaller timeframe

Once we get confirmation:

-

Set your Stop Loss below the 78.6% level (or last low)

-

Set your Take Profit at the previous high/low, or the 127% or 161.8% extension level

Real Trade Example

-

Pair: EUR/USD

-

Timeframe: 1 Hour

-

Trend: Uptrend

-

The price moved up strongly

-

It pulled back into the 61.8% zone

-

A bullish engulfing candle formed

-

We entered the trade

-

Stop Loss was placed below the 78.6% zone

-

Take Profit was set at the previous high

Result: A smooth and profitable trade with a good risk-reward ratio.

Mistakes to Avoid

-

Drawing Fibonacci on wicks instead of candle bodies

-

Using it against the main trend

-

Entering trades just because price touched a Fib level

-

Ignoring other signals like support/resistance or confirmation candles

Useful Tools for Fibonacci Trading

-

TradingView – Best for drawing clean Fibonacci levels

-

Trading Journal – Helps you track your setups and improve

-

Backtesting – Practice on at least 20 setups before trading live

-

Mentorship – Get feedback to fix emotional or technical mistakes

How STRATEGIC Helps You Learn

In our training sessions:

-

Students draw Fibonacci levels on live charts

-

Coaches give feedback and correct mistakes

-

We use Fibonacci for both short-term and long-term trades

-

Weekly results are tracked and reviewed to help you improve

This is not just theory — it’s real practice with expert guidance.

Strategy Turns Tools Into Results

Fibonacci works best when you use it the right way — with a clear trend, confirmation, and a strong plan.

When used correctly, it becomes a powerful tool in your trading toolbox.

Want to learn more? Join our training program and start building your trading skills — one smart step at a time.

FAQs

Q1: What is Fibonacci retracement?

A: It’s a tool that helps traders find where the price might pull back (go the other way for a short time) before it continues in the same direction. It uses levels like 38.2%, 50%, and 61.8%.

Q2: How do I draw it correctly?

-

In an uptrend, draw it from the lowest point (start) to the highest point (end).

-

In a downtrend, draw it from the highest point to the lowest point.

Always follow the direction of the trend.

Q3: Which levels are most important?

-

38.2% – small pullback, trend is still strong

-

50% – common level where price might bounce

-

61.8% – powerful reversal area, called the “golden level”

Q4: Can I use this on any chart timeframe?

A: Yes! It works on all timeframes — from 1-minute to daily charts.

But it’s usually more reliable on higher timeframes, like 1 hour or 4 hour.

Q5: Is it always accurate?

A: Not always. It doesn’t give exact predictions, but many traders use it — so prices often react at those levels.

It works best when used with other tools like trendlines or candlestick patterns.

Q6: What’s the difference between retracement and extension?

-

Retracement = where the price might pull back before continuing.

-

Extension = where the price might go next after continuing the trend (like 127% or 161.8%).

Q7: Should I enter a trade as soon as price touches a level?

A: No! Always wait for confirmation.

Look for signs like:

-

A strong candle in your direction (engulfing candle)

-

A wick or rejection showing price bounced

-

A structure break on a smaller timeframe

Q8: Can beginners use Fibonacci retracement?

A: Yes! It’s simple to learn and great for beginners — especially when you use a step-by-step method and practice regularly.

Q9: What are common mistakes to avoid?

-

Drawing Fibonacci on the wrong move

-

Using it against the trend

-

Entering trades with no confirmation

-

Ignoring important timing, like news or session open

Q10: What tools can help me practice?

-

Use TradingView for drawing on charts

-

Keep a trading journal to track and improve

-

Do backtesting to test your setups

Get mentorship or join a training program for support and feedback

Final Thoughts

Fibonacci isn’t a shortcut to get rich.

But when used with discipline and a solid system, it:

-

Helps avoid random trades

-

Adds logic to stop loss and profit targets

-

Builds your confidence as a trader

At STRATEGIC, we teach Fibonacci not as a trick — but as a key part of a professional trading system.

want to read more articel visit our website

Big Shoutout to the guys who made this blog happen UDM.