Mastering Market Structure: The Core of Every Winning Strategy. In the trading world, you’ll find hundreds of strategies fighting for your attention—colorful indicators, expensive signal services, and bold promises of instant success. But here’s the truth: no matter how advanced a strategy looks, if you don’t understand how price moves, you’re basically guessing. And guessing isn’t trading.

That’s why learning Market Structure is not just important—it’s essential. It’s the foundation that every successful trader builds on.

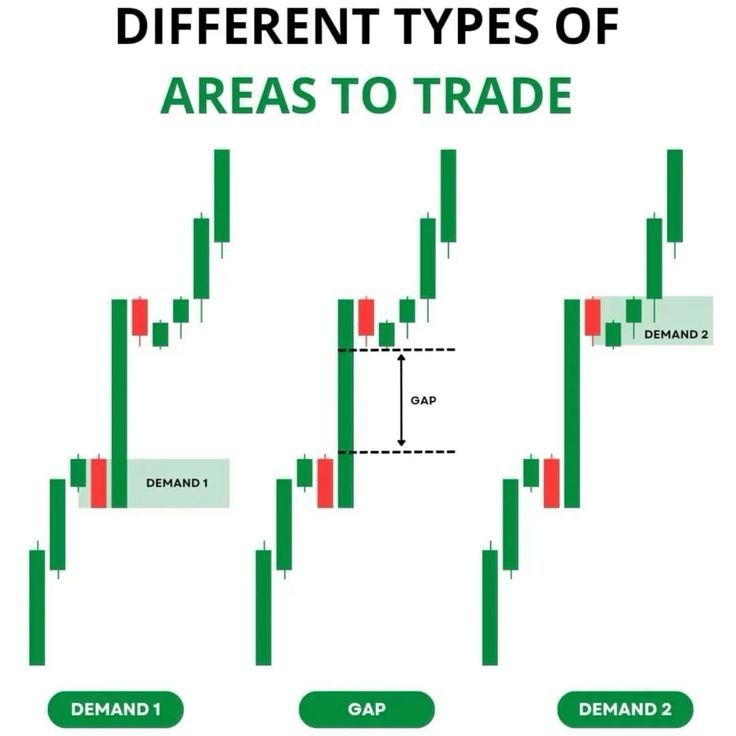

Before you try advanced techniques like Fibonacci retracements, order blocks, or liquidity zones, you need to understand one simple idea: price moves in patterns. These patterns are not random. They follow a structure based on how buyers and sellers behave. If you can recognize these structures, you won’t need to depend on signals or indicators—you’ll be able to read the market with clarity.

Mastering Market Structure: The Core of Every Winning Strategy

At STRATEGIC, we introduce Market Structure at the very beginning of our training program—not as a set of theories or textbook definitions, but as a practical, visual framework that reflects how price behaves in real time. We treat it as a language—one that traders must learn to read and speak fluently before they can make confident decisions in the market.

Market Structure is the roadmap behind price action. It reveals the intentions of buyers and sellers and helps you understand where price is likely to go next. Our training guides you through identifying core structural elements such as swing highs and lows, trend continuation patterns, consolidation zones, and reversal signals. Rather than memorizing setups, you’ll learn how to interpret market context and recognize the underlying story behind each move on the chart.

We focus on structure because it builds intuition. You’ll know when a market is trending, ranging, or transitioning—and more importantly, how to adapt your strategy accordingly. This allows you to pinpoint entry and exit points with greater precision, manage risk intelligently, and avoid common traps like chasing price or entering trades in unclear conditions.

What Is Market Structure?

Market structure is the blueprint behind every price move. It’s the skeleton of price action, representing the ongoing battle between buyers and sellers. At its core, market structure reflects how price flows through trends, consolidations, reversals, and breakouts.

The basic elements of market structure include:

-

Higher Highs (HH)

-

Higher Lows (HL)

-

Lower Highs (LH)

-

Lower Lows (LL)

Why This Matters

By identifying these key formations, traders can:

-

Determine the current market direction (bullish, bearish, or ranging)

-

Spot reversal points before they happen

-

Place smarter entries and stop-loss levels

-

Eliminate emotional and impulsive trades

Think of market structure as learning how to read a map. Without it, you’re just reacting. With it, you’re navigating with purpose.

Why Most Traders Ignore Market Structure

Despite its importance, most beginner and even some intermediate traders ignore market structure entirely. Why?

Because they’re distracted by:

-

Fancy indicators

-

Lagging signals

-

Overpriced strategies with branded names

-

YouTube tutorials focused on “easy money”

But here’s the painful truth:

Without understanding market structure:

You don’t know the trend

You won’t know where to place your stop-loss

You can’t identify high-probability entries

You’ll fall into market traps again and again

At STRATEGIC, we fix this problem by returning to first principles. We teach students how to analyze raw price action — no indicators, no crutches, just structure.

Structure in Action: A Real-Life Example

Let’s break down a simple scenario.

Imagine this price flow:

-

Price pushes up → Higher High (HH)

-

Price pulls back → Higher Low (HL)

-

Another push upward → New Higher High

This is a bullish structure. It continues as long as price keeps forming higher highs and higher lows.

Now, what happens if price forms:

-

A Lower High (LH) followed by a Lower Low (LL)?

That’s a bearish structure. The trend has shifted.

How This Changes Your Trading Game

Recognizing this sequence helps you:

-

Enter trades based on logic, not emotion

-

Set realistic targets in alignment with structure

-

Place stop-losses below/above structure instead of random levels

-

Understand market intent, not just react to candles

When you master market structure, you stop gambling and start trading with clarity.

How STRATEGIC Teaches Market Structure (Step-by-Step)

Our students don’t just read about market structure — they train it like a language. In Phase 2 of our mentorship, structure becomes the focus.

Here’s how we break it down:

1. Chart Markups

Students practice daily chart markups on TradingView, identifying:

-

Swing highs and lows

-

Breaks of structure (BOS)

-

Reversal points and trend continuations

2. Structure Journals

We require all students to maintain a Structure Journal. This includes:

-

Daily analysis of structure shifts

-

Bullish vs bearish scenarios

-

Hand-drawn notes to train pattern recognition

3. Simulations & Mentorship

In live trading sessions, students:

-

Watch real-time markets with mentors

-

Analyze volatility during key news events

-

Get instant feedback on their structure reads

4. Weekly Review Sessions

Each week, students submit:

-

Their marked-up charts

-

Trade decisions based on structure

-

Questions about difficult setups

Mentors provide direct feedback, correcting structure misreads and reinforcing good habits.

We focus on mastery through repetition — not memorization or shortcuts.

From Market Structure to Full Strategy

Once a student understands structure, they’re ready to layer advanced tools on top.

But without structure, these tools are meaningless.

At STRATEGIC, we introduce:

-

Fibonacci retracement and extension tools

-

Order blocks and imbalances

-

Liquidity zones and sweeps

-

Internal vs external range logic

-

Break of structure (BOS) vs Change of Character (ChoCH)

Each of these concepts enhances strategy precision — but only after market structure is mastered.

Structure is the foundation. Everything else is refinement.

Why STRATEGIC Traders Prioritize Structure

Our funded traders, who consistently pass evaluations and manage real capital, don’t rely on luck or signals. They follow a disciplined structure-based system.

They’re trained to:

-

Enter trades only when structure confirms their bias

-

Avoid trades against the prevailing trend

-

Prioritize structure over indicators

-

Journal every trade with structure logic (not gut feeling)

This approach leads to:

-

Fewer losses

-

More consistent wins

-

Stronger confidence under pressure

At STRATEGIC, we don’t believe in signals.

We believe in readable, reliable market structure.

Mastering Market Structure = Mastering the Market

Here’s the truth most traders never hear:

If you’re trading without structure, you’re driving with your headlights off.

You might get lucky for a while. But eventually, the fog will catch up.

When you master structure:

-

You trade with confidence

-

You adapt to any market condition

-

You build a scalable, long-term trading career

That’s what we offer inside STRATEGIC — not gimmicks, not guesses. Just a clear, repeatable roadmap to market mastery.

Frequently Asked Questions

1. What exactly is “Mastering Market Structure”?

Market structure refers to the underlying framework and patterns of price movement in financial markets. It’s essentially a visual map of where the price has been and how it’s moving, identifying key elements like swing highs, swing lows, support, and resistance levels. It helps you understand the “flow” of the market.

2. Why is understanding Market Structure so important for a winning strategy?

Market structure is the foundation of effective analysis. It provides clarity on current market conditions (trending, ranging, or transitioning), helps anticipate future price movements, identifies high-probability entry and exit points, and allows traders to align with the “smart money” flow, avoiding common retail traps. Without it, strategies lack a crucial compass.

3. How does Market Structure differ from “Price Action”?

While closely related, Market Structure is the broader, static “map” of historical price movements, organizing them into discernible patterns and levels. Price Action, on the other hand, focuses on the dynamic, real-time movements of individual candlesticks or bars, providing granular details within the larger structure. Market structure gives you the big picture, while price action helps you pinpoint precise entries.

4. What are the key components I should look for when analyzing Market Structure?

Essential components for Mastering Market Structure include:

-

- Trends: Identifying whether the market is making higher highs and higher lows (bullish), or lower highs and lower lows (bearish).

- Ranges/Consolidation: Periods where price moves sideways.

- Swing Highs and Lows: Pivotal points where price reverses direction within a trend or range.

- Support and Resistance: Price levels where buying (support) or selling (resistance) pressure is concentrated.

- Market Structure Shifts (MSS) / Change of Character (CHoCH): Signals of potential trend reversal.

- Break of Structure (BoS): Confirmation of trend continuation.

5. What is the role of “impulse moves” and “pullbacks” in Market Structure?

These are fundamental to understanding market flow. Impulse moves are strong, directional movements that drive the trend. Pullbacks (or corrections) are temporary retracements against the impulse, often presenting opportunities for traders to enter or add to positions in the direction of the dominant trend.

Final Thoughts: Build Your Trading Legacy on Structure

The trading world is full of noise. But successful traders learn to filter that noise through structure.

Whether you’re a beginner looking to escape losses or an experienced trader seeking consistency — Mastering Market Structure is the key.

At STRATEGIC, we don’t just teach structure. We make it second nature.

If you’re serious about becoming a disciplined, profitable trader, your journey must start here.

Master structure — and you master the market.

want to read more article visit our Blogs

Big Shoutout to the guys who made this blog happen UDM.