Every successful trader knows that mastering indicators or fancy tools isn’t the secret to consistent profits — the real power lies in understanding market structure. Market structure is the foundation of all price movement. It tells the story of how buyers and sellers interact, how trends are formed, and where reversals begin. Whether you trade […]

Blog

Support and Resistance Zones: The Hidden Map of Price Action

In the dynamic world of trading, few concepts are as foundational and as misunderstood as support and resistance zones. Whether you’re a beginner learning the basics of technical analysis or an experienced trader fine-tuning your strategy, understanding how to identify and trade around these levels can dramatically enhance your performance. Support and Resistance Zones: The […]

Inside STRATEGIC Training Phase 4: The Discipline of Sustainable Trading

Inside STRATEGIC Training every trader eventually reaches a point where short-term wins and lucky trades aren’t enough. Real success doesn’t come from quick profits or random signals — it comes from discipline, clear systems, and control over emotions. Phase 4 of the STRATEGIC Training Program is designed for this stage. Unlike earlier phases that focus […]

STRATEGIC Training Program Phase 4: From Trader to Strategist

STRATEGIC Training Program every trader starts with curiosity, but only a few have the focus and discipline to reach true mastery. Phase 4 of the STRATEGIC Training Program is where this transformation happens — turning traders into strategists. While earlier phases teach strategies and basic trading skills, Phase 4 focuses on long-term success, emotional control, […]

Ethical Trading in the AI Era: Why Principles Still Matter More Than Technology

Ethical Trading in the AI Era atificial Intelligence (AI) is changing trading. Today, smart algorithms and automated bots can analyze markets faster than humans, spot opportunities, and even suggest trades. Many traders see this as a way to “let machines do the work” and make easy profits. But the key question is: Can AI replace […]

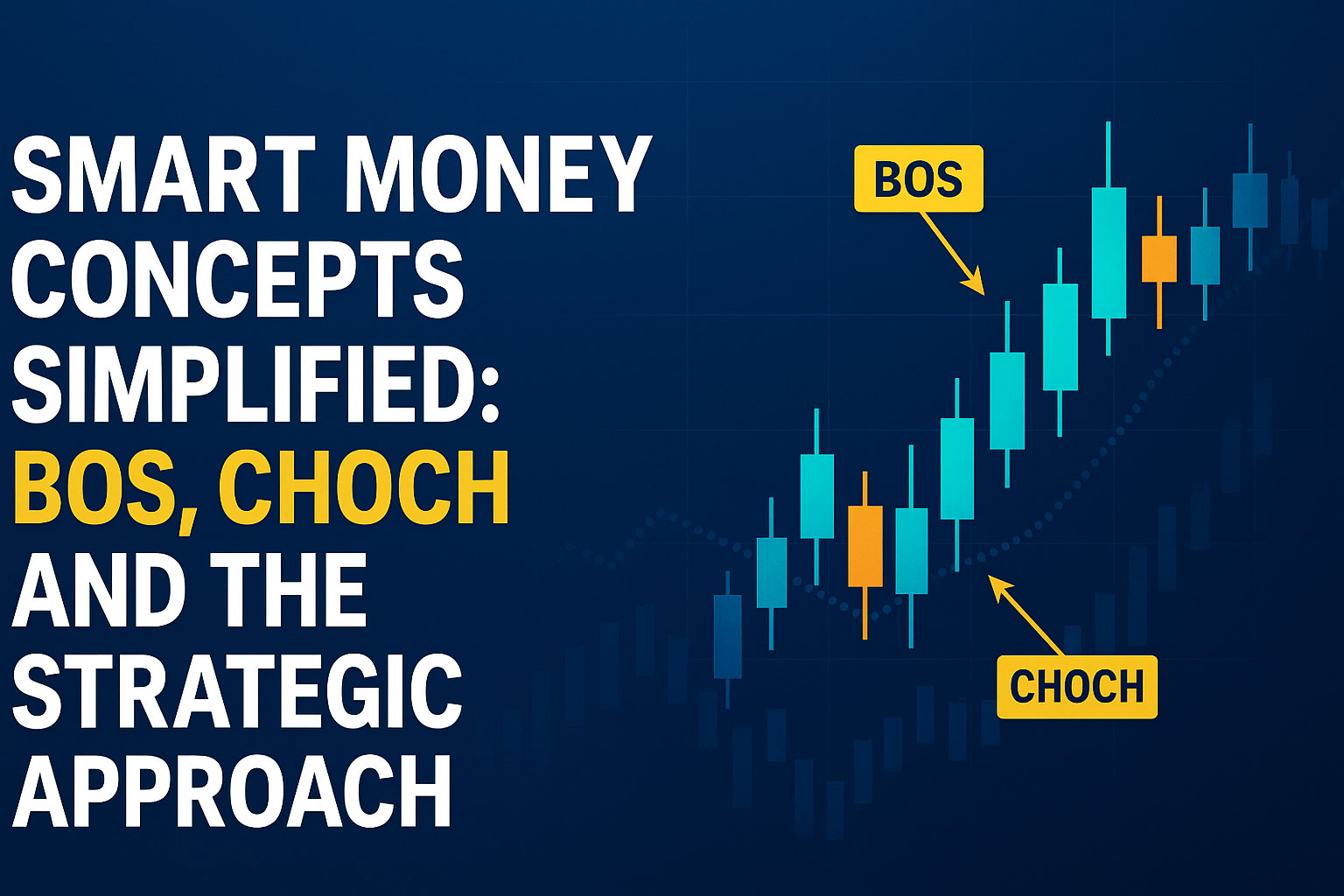

Smart Money Concepts Simplified: BOS, CHOCH, and the STRATEGIC Approach

Smart Money Concepts Simplified trading has changed a lot in recent years, and Smart Money Concepts (SMC) have become a key tool for understanding the market. Concepts like Break of Structure (BOS) and Change of Character (CHOCH) help traders see when trends continue or might reverse. Learning these ideas can give traders an advantage, but […]

Old Mindset vs. STRATEGIC Way: The Shift from Gambling to Structured Trading

Old Mindset vs. STRATEGIC Way many new traders start with the hope of making quick money in the markets. They follow tips, signals, or social media advice, hoping luck will bring them profits. This is the old mindset—trading like a gamble. Decisions are based on emotions, guesses, and random chance instead of planning and skill. […]

STRATEGIC’s Complete Process: System-Based Trading, Risk Management, and Ethical Growth

STRATEGIC’s Complete Process These days, many online platforms promise “easy money” through quick trades, apps, or influencer tips. They may look exciting, but most of the time they lead to stress, losses, and wasted time. Real trading is not about luck — it’s about skill, structure, and discipline. At STRATEGIC, we focus on building traders […]

Why Gambling and Binary Trading Have No Place in Pakistan’s Future Economy

Pakistan’s economy is going through an important change. For many years, gambling-style apps and binary trading platforms have attracted young people with the promise of “quick and easy money.” These platforms make it look simple — just predict whether the market will go up or down — but in reality, they do more harm than […]

Hidden Risks of Binary Trading: Why STRATEGIC Stay Away

Hidden Risks of Binary Trading: Why STRATEGIC Stay Away. At first, binary trading may look like a fast and easy way to make money online. The idea seems straightforward—you just guess if the price of an asset, like a stock, currency, or commodity, will go up or down in a short amount of time. If […]